When a Company earns profits or surplus, due to increased earnings or increased cash flow due to the sale of assets, it can decide to pay a portion of its profits as dividends to its shareholders. It is a way of saying thank you to shareholders for their consistent support and incentivizing them to continue holding the stocks. The Companies Act, 2013 provides provisions for the declaration and distribution of dividends and provides a penal clause if payment is not made within the prescribed time limit. The moot question is if payment of the dividend is made beyond the prescribed time limit, can the company claim exemption from penal provisions?

Section 124 of the Companies Act, 2013 says that the dividend declared by the company shall be paid within 30 days from the date of declaration. If any dividend remains unpaid or unclaimed within 30 days from the date of declaration, the total unpaid/unclaimed dividend shall be transferred to a special unpaid dividend account opened by the company in a scheduled bank.

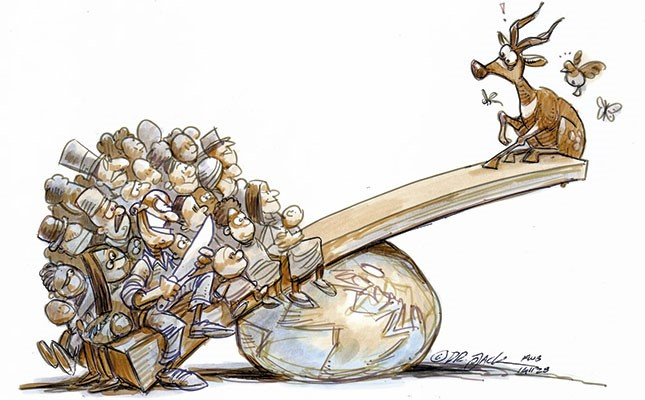

There might be instances when a company cannot pay its declared dividends within the prescribed time limit. Section 127 of the Act while providing punishment for non-payment of declared dividends on time, also provides for 5 instances when the company is deemed not to have committed the offence under Section 127 viz., due to operation of law, specific directions for payment of dividend as given by shareholder cannot be complied with and the same has been informed to the shareholder, existence of dispute regarding the right to receive the dividend, adjustment of dividend against any sum due to the company by the shareholder and any other reason not due to any default on part of the company. However, such exceptions are allowed only after careful consideration of the facts of each case.

In a recent judgement against a telecom company, the Karnataka High Court held that the company cannot be exonerated from penal provision even though the Company had made subsequent payment of dividend with interest. Timely compliance with statutory provisions under the Company law is deemed essential to avoid penal provisions provided under the Companies Act and any attempt to patch up the non-compliance is normally not entertained by the Courts.

SWATHI.K, Assistant Professor