The 18th general election to Lok Sabha seats are being held in India from 19th April to 1st June 2024. A lot of controversies and issues are going on as a part of election campaign. One such controversy began with Sam Pitroda, Congress leader when he proposed the concept of “Inheritance Tax “which was opposed by our Prime Minister, Narendra Modi in his election campaign.

What is inheritance tax and how long has it been prevailing? As the term denotes, it is a tax levied on the assets that will be inherited to the heirs. Though it looks like a socialist concept, after the first world war, it was mainly started by capitalist countries. Many western countries have been following this for more than a century. As of now, Japan levies inheritance tax at the rate of 55%.

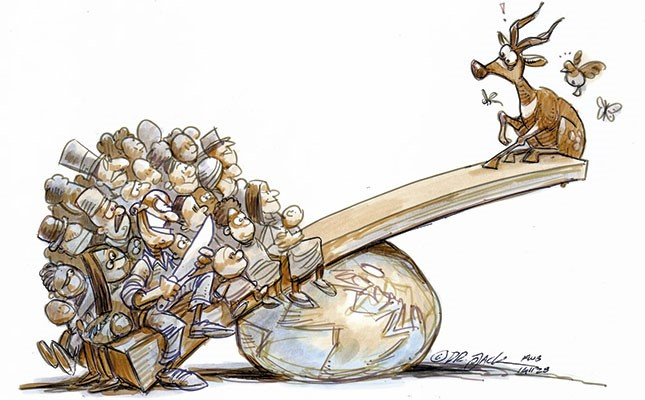

Inheritance tax is considered to be one of the best fiscal inventions of the 20th century. There is a lot of disparity existing in the society among individual’s income and wealth which can be referred to as economic inequality. The wealth and resources are concentrated in very few people’s hands resulting in making them out of reach for a section of society. Inheritance tax basically aims at reducing the concentration of wealth and redistributing them. This in turn makes the economic system fairer and is a very good source of income to the government.

The Indian culture is set up in such a way that the parents live their life only to provide inheritance to their children. The upper-class group preserves their money so that the legacy remains. While the middle- and lower-income group, within their limited income and resources cannot find a way to increase their standard of living. Whatever they earn, they save it for their children, rather than living their life. So, the introduction of inheritance tax is more than enough to create pressure among the people. But levying inheritance tax will not be a hassle for the middle income or lower income group. This is because not all inheritance is taxable. This tax is mainly aimed at the upper class where they earn money without any effort. And looking into the economic environment of India, only very few people will be accountable under inheritance tax.

Earlier in India, there were estate duty and wealth tax which were similar to inheritance tax. Estate duty was calculated at the time of death of a person where as wealth tax was calculated before the death of a person. Both were levied on the same property, there was only difference in the time of levy. These were later abolished as it amounted to double taxation, high administrative cost and no contribution to economy.

In short, even if inheritance tax will be introduced in India, it will affect only a very small group who belongs to upper class and will ultimately result in growth of economy.

Mrs. Sreelakshmi (Assistant Professor)