When ‘ola’ came calling in 2010, the way citizens commuted in urban areas underwent a great transformation. App-based cab aggregators introduced an uber-cool lifestyle to the average Indian who was, until then, waging a daily war against traffic. However, there were instances when these cab aggregators surged their prices during peak times taking advantage of the helpless situation of the consumer.

The earlier Consumer Protection Act, of 1986 did not contain provisions to cover online transactions within its ambit and therefore, the law protecting a consumer of e-taxis was uncertain. The Consumer Protection Act, 2019, however, included the e-consumer ie., a person who makes online transactions through electronic means within the ambit of the definition of the consumer u/s 2(7) of the Act. The Consumer Protection (e-commerce) Rules, 2020 dealt extensively with e-commerce-related issues and remedies available to the user of e-commerce services.

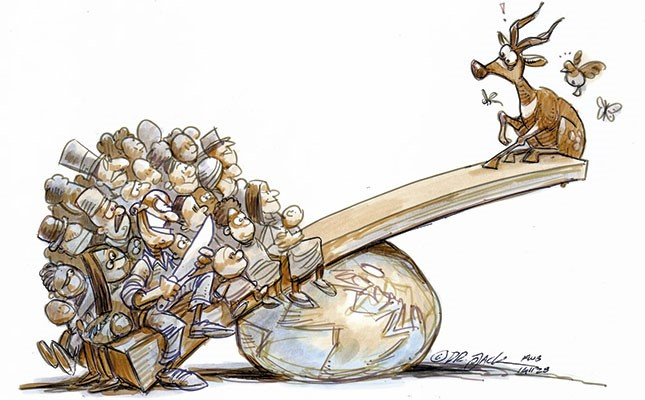

The e-commerce services received statutory recognition under the CPA, 2019, however, the mode of functioning of online services was different from traditional modes of service delivery or product delivery. These websites essentially function on the basis of electronic contracts which are standard forms of contracts and unilateral. The terms and conditions which must be agreed to by the consumer are non-negotiable and the consumer is left with no option but to accept the terms and conditions if he/she wants to use the app or avail of the services provided under the app. However, such contracts fail to meet the essential standards of a valid contract.

Recently, the District Consumer Dispute Redressal Commission, Hyderabad in Rajkumar Gummi v Uber India Systems Private Limited, observed that the terms of the non-negotiable contract would be held to be unfair if they are detrimental to the parties. The Consumer Protection (E-commerce) Rules, 2020 and the Motor Vehicles Act, 1988 require standard contracts to be fair and equitable.

The District Commission held that there was no transparency in the cancellation criterion of the defendant company and the information conveyed to the customer was partial and incomplete.

The defendant company cannot burden its customers with unreasonable operational costs. Charging cancellation fees even when the ride was cancelled by the driver established non-transparent pricing and hence amounted to unfair trade practice on part of the company. This is a welcome move by the District Commission since it provides a remedy to the consumer of e-commerce services which was hitherto unavailable and a step in the right direction towards consumer empowerment.

SWATHI.K, Assistant professor